Seattle Shoreline Master Plan Receives Final Approval Ecology Director Maia Bellon signed the final approval for the City of Seattle’s Shoreline Master Program on Monday June 1, 2015. The updated SMP will go into effe...

Mortgage Info

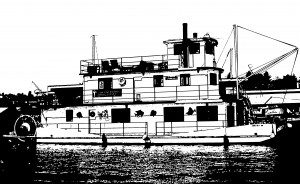

New Houseboat Lending Program from Sound Community Bank We are very pleased to announce that with new Houseboat regulations, Sound Community Bank is creating a new Floating On Water Residence lending package that impr...

Posted by:

Linda Bagley

New Credit Scoring Available to Consumers and Lenders This is pretty exciting news for those of us who prefer not to use credit cards and prefer to pay cash for what we buy. You will now have a number and a grade A, B...

Posted by:

Linda Bagley

Categories:

Mortgage Info

The Fair Credit Reporting Act (FCRA) requires each of the nationwide consumer reporting companies: Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 1...

Posted by:

Linda Bagley

Categories:

Mortgage Info

Land Contract An alternative to a non-conforming loan is the use of a land contract, which is allowed in some states. A land contract is an agreement between a buyer and a seller, where the buyer agrees to make period...

Posted by:

Linda Bagley

Categories:

Mortgage Info

The No-Cost Thirty Year Fixed Rate Mortgage There really is no such thing as a “no-cost” mortgage loan. There are always costs, such as appraisal fees, escrow fees, title insurance fees, document fees, pro...

Posted by:

Linda Bagley

Categories:

Mortgage Info

The Advantages of Different Types of Mortgage Lenders What kind of lender is “best?” If you ask a loan officer, “What kind of lender is best?” it is going to be whatever kind of company he work...

Posted by:

Linda Bagley

Categories:

Mortgage Info

Types of Mortgage Lenders Mortgage Bankers Mortgage Bankers are lenders that are large enough to originate loans and create pools of loans which they sell directly to Fannie Mae, Freddie Mac, Ginnie Mae, jumbo loan in...

Posted by:

Linda Bagley

Categories:

Mortgage Info

Where Does the Money Come From for Mortgage Loans? In the “olden” days, when someone wanted a home loan they walked downtown to the neighborhood bank or savings & loan. If the bank had extra funds layi...

Posted by:

Linda Bagley

Categories:

Mortgage Info

Items You Need for When Applying For a Loan Have These Items Ready When You Apply For a Loan It used to be that lenders mailed out verifications to employers, banks, mortgage companies, and so on, in order to verify t...

Posted by:

Linda Bagley

Categories:

Mortgage Info